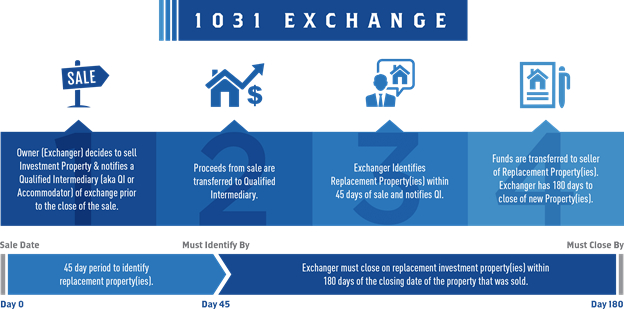

1031 EXCHANGE

Managing the tax implications of your real estate assets can be overwhelming and discouraging. We take a holistic approach to 1031 Exchanges, taking into consideration your entire financial life and your retirement needs. Let us help you navigate the real estate tax landscape through the use of 1031 Exchanges and Delaware Statutory Trusts (DSTs).

WHAT ARE THE POTENTIAL BENEFITS OF A 1031 EXCHANGE?

In addition to deferring capital gains tax, other benefits may include:

There are specific definitions for the types of like-kind property, as well as other items, that can be included and how they are handled from a tax perspective. We’ll help sort these guidelines out in the way that benefits you best.

The capital gains tax deferral an exchange provides to the taxpayer might, at first glance, seem to be a kind of a gift from the United States government, however, it is, in reality, closer to an interest-free loan, because the taxpayer is expected to “repay” the extra funds gained from the capital gains tax deferral by accepting capital gains liability on the subsequent sale of a replacement property. Additionally, this “interest-free loan” may be kept by the investor indefinitely; an investor can choose to make any number of 1031 exchanges before finally sell outright, at which point capital gains taxes must be paid.

WHAT IS A 1031 EXCHANGE DST?

DST is an acronym for Delaware Statutory Trust. A DST is a fractional ownership trust. Through a DST a separate legal entity is created as a trust under Delaware state law. In essence, the DST is used as the “exchange property” for a 1031 Exchange. A Delaware Statutory Trust, which is a legally recognized trust for the sole purpose of business. A DST does not necessarily need to be in the State of Delaware, and can also be referred to as a UBO or Unincorporated Business Trust. Delaware Statutory Trusts are private governing agreements under which property is managed, invested, administered, helped, and/or operated. Professional activities for profit are carried out by one or more trustees to benefit the trustor that has gainful interests in the property.

DST investments are commonly a replacement property for investors that are accredited and are seeking to defer their capital gains taxes by using a 1031 tax-deferred exchange, with a straight cash investment for investors looking to diversify their holdings. The DST property ownership allows a smaller investor to own a fractional interest in a quality, professionally managed commercial property.

DST Ownership

A DST ownership option essentially offers the same risks and benefits that a large-scale investor would receive, without the management responsibilities. Each Delaware Statutory Trust property is managed by professional property managers and real estate investment managers. Large institutional investors like life insurance companies, Real Estate Investment Trusts (REITs), etc., could invest in these types of properties. With the 1031 exchange replacement option through a DST, smaller investors can invest in diverse selections of institutional quality properties. You can find DST investments throughout the United States. Properties may include office buildings, industrial properties, multi-family apartments, student housing, and self-storage, just to name a few.

DST Advantages

WHAT ARE THE POTENTIAL BENEFITS OF A 1031 EXCHANGE DST?

Perhaps the biggest advantage of a 1031 Exchange DST over a traditional 1031 Exchange is the fact that you no longer have to be a landlord. With a DST you may be in a pool of 100 or more investors with fractional ownership of anything from a healthcare facility to a gym to an office building. On the other hand, you lose direct control over your investment, however, for many investors that is a benefit, not a detractor.

Extensive property due diligence is also an attractive feature of a 1031 Exchange DST. There are 6 levels of due diligence that are performed on all properties before they can be approved as a DST investment:

1. The Sponsor provides research, underwriting, sourcing for all third-party reports including appraisal, environmental, and property condition reports along with financial underwriting analysis.

2. The Lender underwrites the property and sponsor in their own due diligence.

3. The Attorney drafts the private placement memorandum (PPM) and writes the tax opinion on the property.

4. The Broker-Dealer reviews sponsor, PPM, and third-party reports to their own strict standards.

5. The Third-Party Due Diligence Firm provides an internal report to the broker-dealers.

6. The Registered Representative reviews all information plus establishes client suitability. As additional due diligence, investors can tour the properties before investing.

WHAT ARE THE POTENTIAL RISKS OF A 1031 EXCHANGE OR A 1031 EXCHANGE DST?

Risks include general real estate and market risk and the risk of owning, selling, and operating real estate. Additionally, DSTs are subject to the fact that there can be no assurance that a property will perform as projected. DSTs are also subject to economic volatility and tenants not paying their rent in a timely fashion. Beneficial Owners possess limited control and rights. The trust will be operated and managed solely by the Trustee. Beneficial Owners have no right to participate in the management of the trust. Beneficial Owners do not have legal title. Beneficial Owners do not have the right to sell the property.

*Acquisition of Delaware Statutory Trusts (DSTs) must be performed by a licensed financial advisor. For more information, please visit the website for licensed DST advisor: Platinum Wealth Group - Justin Lowy, MFP,AWMA, at (714) 333-1305. Contact Justin today and explore the opportunities available to you at justin@platinumwg.com. Justin is well known as one of the nation's top DST advisors and only deals with the top-rated companies in the industry.